116th Congress

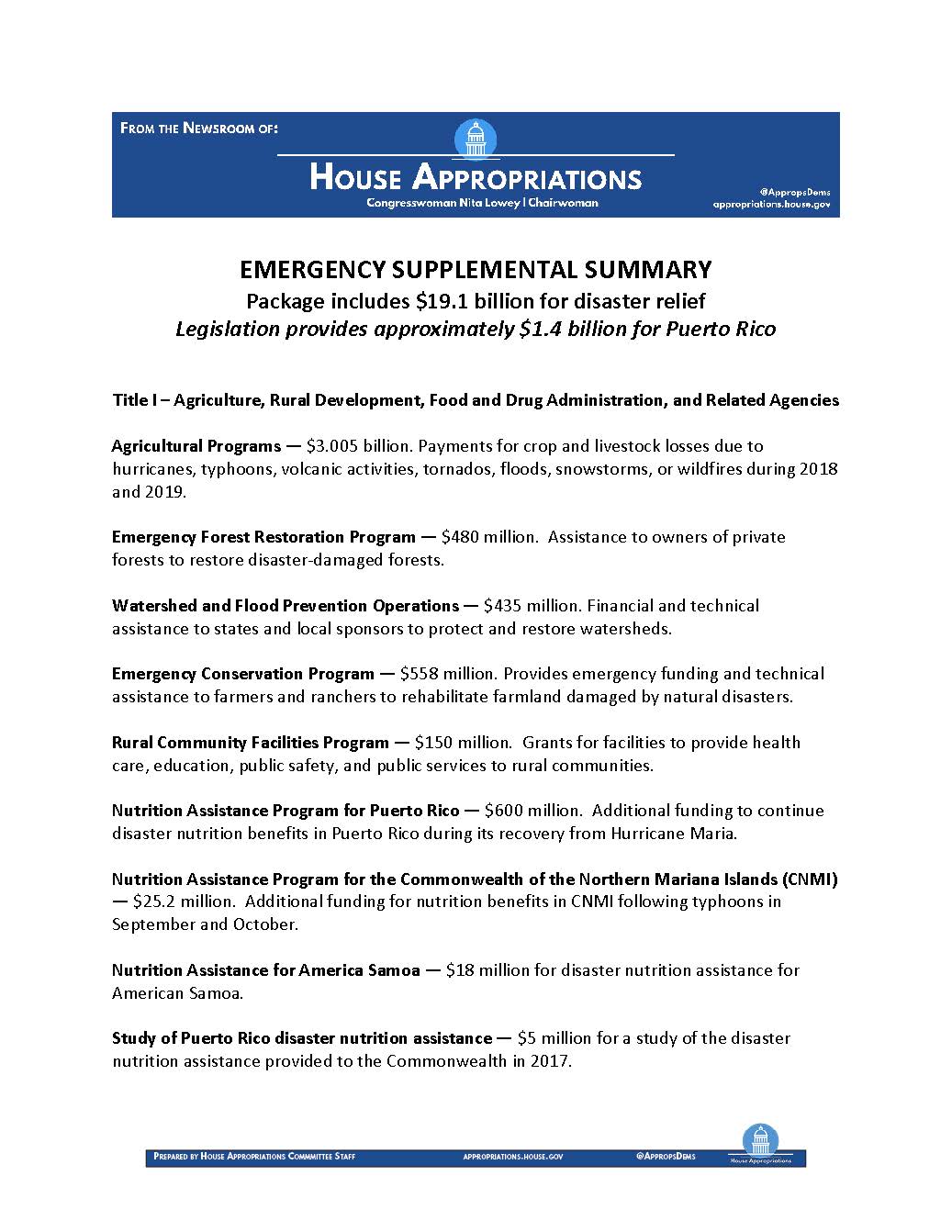

WASHINGTON — The House today passed, on a bipartisan 354 to 58 vote, legislation to provide relief and recovery assistance for Americans affected by hurricanes, typhoons, wildfires, and other recent natural disasters.

WASHINGTON — House Appropriations Committee Chairwoman Nita M. Lowey (D-NY-17) today delivered the following remarks on the House Floor in support of $19.1 billion bicameral, bipartisan disaster relief legislation:

Today we are rejecting the political stunts and grandstanding that have made it difficult to deliver much-needed disaster relief to families and communities across America.

It's been nine months since Hurricane Florence struck the Southeast, just one of the many natural disasters – including other hurricanes, Pacific typhoons, and Western wildfires – that impacted our fellow Americans last year.

In that time, the House has already passed two strong packages of relief and recovery assistance; bills to help the people of Puerto Rico recover from one of the deadliest and costliest storms in American history; and to meet urgent needs following Midwest floods and Southern tornadoes.

Download the full fact sheet here.

WASHINGTON — The House Appropriations Committee today released the draft fiscal year 2020 Financial Services and General Government funding bill, which will be considered in subcommittee on Monday, June 3. The legislation provides annual funding for the Department of the Treasury, the Judiciary, the Executive Office of the President, and other independent agencies, including the Small Business Administration.

In total, the draft bill includes $24.55 billion in discretionary funding, an increase of $1.4 billion over the 2019 enacted level and $355.5 million over the President's 2020 budget request. In addition, the bill includes $400 million under a discretionary program integrity cap adjustment for the Internal Revenue Service (IRS) to fund new and continuing investments to expand and improve the effectiveness of the IRS's overall tax enforcement program.