Ranking Member Hoyer Statement at the Full Committee Markup of the 2024 Financial Services and General Government Funding Bill

Congressman Steny Hoyer (D-MD-05), Ranking Member of the Financial Services and General Government Subcommittee, delivered the following remarks at the Appropriations Committee's markup of the fiscal year 2024 Financial Services and General Government bill:

– As Prepared For Delivery –

Madam Chair, let me say from the outset, I believe the debt is a real threat to our long-term success and should be addressed. No one who understands what is necessary to do that believes this debate helps accomplish that goal. This bill, in fact, significantly undermines our ability to reduce the deficit. I will point out just a few of the many ways in which this bill fails the country and the American people.

First, this bill fails to protect or promote the health of the American people. It's a defunding of the enforcers of laws, regulations, and rules established for the protection and benefit of the American people.

Second is the continued undermining of the Internal Revenue Service and its ability to perform its lawful and essential responsibilities. This bill makes it harder to enforce the law by imposing significant cuts on key regulatory agencies. That includes the FTC, the SEC, the Consumer Financial Protection Bureau, the Consumer Products Safety Commission, and the FCC.

In doing so, this bill leaves Americans vulnerable to a variety of threats – from fraud and scams to dangerous products that can harm and even kill adults and children.

Additionally, the bill doesn't provide any funding for EAC election security grants, making our elections more vulnerable to interference and tampering, about which Republicans have been so outspoken.

This bill also withholds funding for the FBI's new consolidated headquarters.

Each year that project is delayed costs taxpayers $268 million dollars and undermines the FBI's mission and the safety of its employees.

There are also significant cuts to other law enforcement agencies, including the Financial Crimes Enforcement Network, the Office of Terrorism and Financial Intelligence, the Office of National Drug Control Policy, and the emergency planning and security costs for the District of Columbia.

So much for supporting law enforcement and public safety.

On top of these harmful cuts are a slew of riders that make the bill even worse. They prohibit the government from improving diversity and equality, limit our ability to combat climate change, further undermine FTC and SEC consumer protections, restrict reproductive health-care access, and interfere with the home rule authority of the District of Columbia.

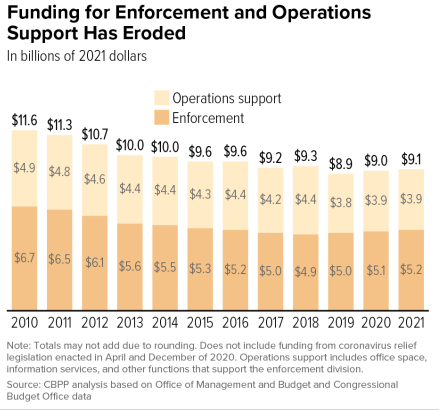

Perhaps the most egregious cut in this bill targets the IRS and its enforcement abilities. For decades, the IRS has been severely under-funded. These graphs illustrate just how dire the situation at the agency has become.

This first graph based on OMB and CBO data shows how the enforcement and operations funding at the IRS has eroded by 21.5 percent between 2010 and 2021.

This funding supports IRS revenue agents with the expertise necessary to conduct complex, high-income audits. Less funding means fewer agents.

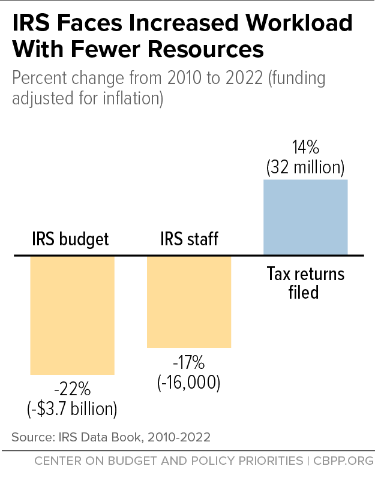

This second graph based on IRS data shows how budget cuts have led to an overall staff decline at the agency of 17 percent between 2010 and 2022. Meanwhile, the number of tax returns filed has increased by 14 percent – or 32 million – in the same time period.

According to Bureau of Economic Analysis Data, the GDP in 1979 was $2.63 trillion compared to $23.315 trillion in 2021. Additionally, the number of annual tax returns increased from 140.1 million in 1979 to 269 million in 2021. Despite this growth, IRS staffing went from 85,398 in 1979 to 78,661 in 2021.

Why would any of us be surprised that phones go unanswered, mail remains unopened, refunds are delayed, returns aren't audited, and owed taxes are left uncollected?

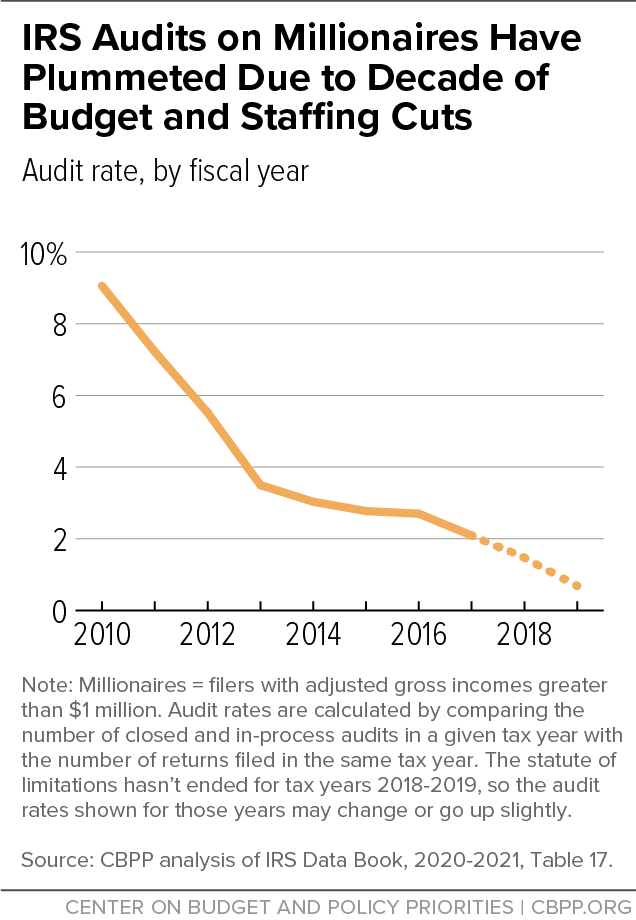

As you can see in this next graph based on the IRS data book for 2020-2021, years of budget and staffing cuts have caused the number of IRS audits on the wealthiest Americans to plummet.

The odds of a millionaire facing an audit in 2010 were around 9%. Recent estimates from Syracuse University indicate that the odds were as low as 1.1% in fiscal year 2022. That's a reduction in oversight of 88%.

This last graph shows how the audit rate for millionaires declined by 71% between 2010-2019. Again, if you include the last three years, that decline is 88%.

Nevertheless, this graph demonstrates how enforcement budget cuts have a disproportionate effect on audit rates for millionaires. Cutting enforcement funding by 24% did not lead to a 24% decline in the millionaire audit rate as one might expect.

Instead, the impact was far greater. We're leaving billions of dollars of revenue on the table by failing to address our nation's ever-growing tax gap. Former IRS Commissioner Charles Rettig made the same point in his testimony before the Senate Finance Committee in 2021.

He said: ‘The Treasury Department has now extrapolated the net tax gap to amount to $584 billion in 2019 – an estimated $7 trillion over the next decade.' Commissioner Rettig of course was appointed by President Trump.

Instead of addressing this problem, this legislation exacerbates it with a 22.2% cut below the request for IRS enforcement for high-earners and corporations. Such a drastic cut has severe consequences for our government's ability to collect the owed taxes it needs to serve the people.

Recent research from Harvard University and the Treasury Department shows that we generate $12 for every $1 we use to ensure high earners pay their fair share. That return on investment comes not only from the audits themselves but also from their long-lasting deterrent effect on others who do not file accurate returns.

Cutting enforcement funding reduces revenue and increases the debt.

The result is the same as simply reducing taxes on wealthy Americans – a cause Republicans have also championed.

My Republican friends claim to be the party of fiscal responsibility. This legislation is a dereliction of that responsibility. Not only are the contents of this bill problematic, so too is the broken process that produced it.

President Biden, Speaker McCarthy, and 314 house members came together to enact a law to address the deficit. Now that agreement is not being honored because of a small but willful minority. I know that some of my friends across the aisle, including Chairman Womack, have similar frustrations.

We can start addressing these faults by putting this unpassable bill aside and working together to ensure that agencies receive the resources they need to enforce the law and protect the American people. Thank you.

###